The recent ByBit hack, described as one of the largest cryptocurrency thefts in history, has sparked widespread discussion about the vulnerabilities of digital asset exchanges.

While the official narrative focuses on a fictitiously sophisticated supply chain attack, this article explores a theoretical perspective: could such detailed explanations of crypto hacks serve as a smokescreen for deeper, systemic issues? Specifically, could these incidents be part of a broader mechanism to siphon funds for purposes far removed from the crypto ecosystem, such as settling debts with military contractors or other shadowy financial operations?

We love how you scroll!

The Official Narrative: A Simplified Hack Breakdown

The ByBit hack, as reported, involved a series of technical vulnerabilities:

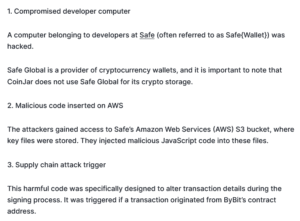

- Compromised Developer Computer: A developer's computer linked to Safe Global, a wallet provider, was hacked.

- Malicious Code on AWS: Attackers injected harmful JavaScript into Safe Global's AWS S3 bucket.

- Supply Chain Attack: The malicious code altered transaction details during the signing process, specifically targeting ByBit's contract address.

- Swift Cover-Up: The attackers replaced the compromised code with clean versions within minutes, erasing evidence.

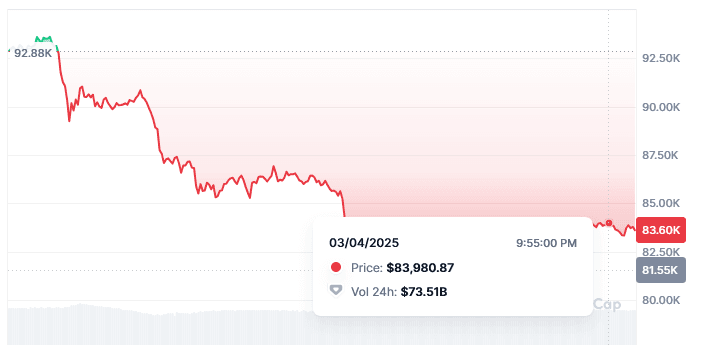

- Impact on ByBit: Users' transactions were silently modified, leading to the theft of $1.5 billion in digital assets.

While the technical details are compelling, they also raise questions. Why are these hacks often explained in such a step-by-step, almost childlike manner? Could this be an intentional strategy to divert attention from more complex, systemic issues?

The intersection of cryptocurrency, political movements, and financial manipulation has long been a topic of speculation and debate. The recent ByBit hack, one of the largest in history, raises questions about the potential use of stolen funds and whether such incidents could be tied to broader political or ideological agendas. While the official narrative focuses on technical vulnerabilities and external attackers, it is worth exploring the possibility that the hack could be linked to far-right group empowerment or other politically motivated financial maneuvers.

Still scrolling?

A Theoretical Perspective: Hidden Agendas Behind Crypto Hacks

The cryptocurrency market operates in a space that is both highly transparent (due to blockchain technology) and deeply opaque (due to the anonymity of participants). This duality makes it an ideal environment for financial maneuvers that might not withstand scrutiny in traditional markets. Here are some theoretical considerations:

- Money Laundering and Debt Settlement: Could the stolen funds be funneled through shadowy channels to pay off debts to military contractors or other entities? The sheer scale of the ByBit hack—$1.5 billion—suggests that the perpetrators were not merely opportunistic criminals but potentially part of a larger, more organized operation.

- Narrative Control: The detailed explanations of how these hacks occur often focus on technical vulnerabilities and human error. This narrative serves to reassure the public that the issue is being addressed while potentially obscuring more troubling realities. For instance, the emphasis on supply chain attacks and compromised third-party code shifts attention away from the possibility of internal collusion or systemic exploitation.

- Blame Shifting: In many cases, state-sponsored actors like North Korea are blamed for large-scale crypto thefts. While this may be true in some instances, it also serves as a convenient scapegoat, diverting attention from potential internal failings or more complex financial schemes.

"Cryptocurrency has become the perfect disguise for multi-level marketing (MLM) Ponzi schemes, where promises of 'guaranteed returns' and 'financial freedom' lure unsuspecting investors into a web of deceit. These schemes often mask their fraudulent nature with buzzwords like 'blockchain innovation' and 'decentralized finance,' but at their core, they operate no differently than traditional Ponzi schemes—relying on new investors' money to pay off earlier participants until the system inevitably collapses."

ByBit’s Response: Transparency or Damage Control?

ByBit’s CEO, Ben Zhou, has pledged to reimburse affected users and has partnered with blockchain forensic firms to track the stolen funds.

While this response has been praised for its transparency, it also raises questions. How does an exchange recover from a $1.5 billion loss? ByBit is reportedly securing bridge loans to cover the losses, but the source of these funds and the terms of these loans remain unclear.

Still scrolling?

Were the Mac is that Apple? Phoning home?

The Broader Implications: Consumerism and Greed in the Crypto Ecosystem

The ByBit hack is not an isolated incident but part of a broader pattern of high-profile crypto thefts. These events highlight the vulnerabilities of a system driven by consumerism and greed. The promise of decentralization and financial freedom often gives way to the harsh realities of speculative trading, market manipulation, and systemic exploitation.

For unsuspecting onlookers, the detailed explanations of these hacks may seem reassuring, but they also serve to obscure deeper issues. The focus on technical vulnerabilities and external attackers diverts attention from the systemic flaws and potential misuse of funds within the crypto ecosystem.

A Call for Vigilance and Accountability

The ByBit hack serves as a stark reminder of the risks inherent in the cryptocurrency market. While the official narrative focuses on technical vulnerabilities and external attackers, it is essential to consider the broader implications. Are these incidents merely the result of human error and sophisticated cyberattacks, or do they point to deeper, systemic issues within the financial ecosystem?

As the crypto industry continues to evolve, greater transparency and accountability will be crucial. Whether through improved security measures, regulatory oversight, or public scrutiny, the community must work together to address these challenges and ensure that the promise of cryptocurrency is not overshadowed by greed and exploitation.

SPACELAUNCH NOW!

Get Your Site Up & Running

SpaceLaunch is an ideal choice for those seeking to swiftly establish their own website, it offers a comprehensive and user-friendly solution backed by essential features, FREE domain registration / transfer / renewal, 1h FREE technical support to get you going, and the flexibility to grow and expand as needed (add-ons available).